What is a Balloon Payment on a Semi-Truck? How Much Will it Cost Me?

Branden started at ATS in 2013 in the settlement department before working his way up to the settlement supervisor role. He is currently a leasing manager. Before Branden came to ATS, he worked at a petroleum company overseeing the dispatch of the oil trucks to gas stations and running their credit cards. He went to college at St. Cloud State and St. Cloud Technical College for business management.

When you hear the phrase, balloon payment, what comes to mind? Do you think about a bouquet of balloons and a clown asking for your money?

Well, if that’s where your head is going, you’re in the wrong direction, my friend. A balloon payment is not, in fact, payment for balloons. It is the final payment you make at the end of a lease.

As this applies to the trucking industry, it’s the final payment you’ll make on your leased truck if you decide to purchase it.

Are you thinking about purchasing your leased semi-truck? Does the idea of being an owner-operator excite you? Then you need to understand what it takes to purchase your truck after leasing it. A lease-purchase agreement can be a great option for you as long as you understand the financial responsibility.

If you’re ready to purchase the truck you’ve been leasing and you’re suddenly surprised by a balloon payment, you might feel upset and financially unprepared.

That’s why this article was written — to prevent that frustration and help you understand what you’re getting into when you decide you want to purchase your truck after your lease agreement is up.

As a leasing manager, I’ve walked drivers through this payment process dozens and dozens of times throughout the years. I’m here to explain what a balloon payment is, how much you can expect to pay and how you can finance the cost.

What is a Semi-Truck Balloon Payment?

A balloon payment is the amount of money you owe on the truck at the end of the leasing period. If you’d like to buy the truck you’ve been leasing, you need to find a way to finance the final payment to have the asset released to you.

If you want to be a true owner-operator, this is one path to get there.

Once you make the balloon payment to the company you leased the truck with, the truck is yours. There is no longer a lease agreement to worry about; you will no longer have to follow the stipulations of that lease.

For instance, if you were unable to modify your truck because your lease didn’t allow it, now that you own the truck you can make adjustments as you see fit. If you had horsepower and speed parameters, you can change them if you want.

You can choose to stay working with the current carrier you are hauling for or you can sign your truck on with another carrier. You may also decide to go the route of a true owner-operator and choose your loads using a load board.

How Much Will My Trucking Balloon Payment Cost?

Unfortunately, the answer is, it depends.

Balloon payments vary depending on a few factors, including the length of the lease and the value of the truck. On average, the lowest buyouts I see are around $5,000. The largest buyouts I see come in around $150,000+.

Some companies offer no balloon payments or low balloon payments. Companies that offer this typically make you sign on for a longer leasing term, or they only offer older trucks for leasing.

How Does The Length of the Lease Term Affect My Balloon Payment?

The shorter the lease term, the higher you can expect the balloon payment to be.

The longer the lease term, the lower you can expect the balloon payment to be.

When you sign a short-term lease, say a year or two, you’re essentially utilizing the truck to haul loads with your carrier. You’re paying to use the truck to make a settlement. In contrast, when you lease for a longer period, you’re building equity in the truck.

Keep in mind that, with most companies, you can buy out at any point during the lease. Some drivers decide to do this because the market is good and they have the money to do it.

How Does The Value of the Truck Affect My Balloon Payment?

The value of the truck when you signed the lease agreement will have a major impact on what your balloon payment will be. If you signed a two-year lease agreement on a truck that was already four years old and valued lower than other trucks on the lot, you can naturally expect that your balloon payment will be lower than if you leased a brand-new truck.

If you leased the newest truck on the lot with the fewest miles, you can expect a larger balloon payment at the end of the lease term.

Mileage and type of truck will directly impact what the truck is valued at. Higher mileage will result in a lower lease payment and a lower balloon payment.

How Can I Finance the Truck Balloon Payment?

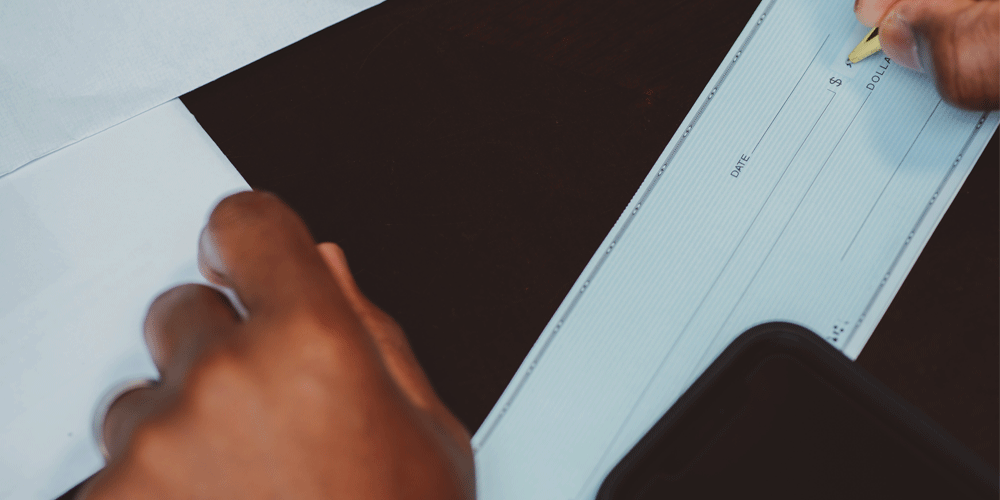

If you’re set on purchasing your truck, there are a few ways that you can pay for it, including a cashier’s check, your maintenance account or financing through your bank.

Cashier’s Check

If you have the funds to pay the balloon payment in your checking or savings account, you can pay off the balloon payment with a cashier’s check.

Maintenance Account

If you have substantial savings in your maintenance account — either because you’ve been saving a lot or you haven’t had to dip into your maintenance account — you can use these funds to pay off the balloon payment.

As long as you don’t owe any back payments on the truck and your maintenance account is in the positive, you can utilize your maintenance account.

Bank Financing

If you don’t have the money to pay the balloon payment upfront, you can pursue financing through a bank or other financial institution. The market is good right now and many banks are providing financing options to drivers that want to purchase their trucks.

Now, instead of paying your leasing company, you’ll make payments to your bank.

Becoming an Owner-Operator

A balloon payment isn’t so frustrating once you understand what it is.

A balloon payment will range in cost depending on your lease term and your truck’s mileage and type. If you don’t have the money to pay for the balloon payment upfront but you’d still like to purchase your truck, you can finance it through your bank.

Financing the balloon payment may be just one step of the process as you consider if being a true owner-operator is right for you. You may still be deciding if you’re ready to take on the responsibility or if you’d like to continue leasing.

That’s why we’ve put together an article that explains what it takes to become a true owner-operator so you can weigh the risks and determine if it’s still the right path for you.