Freight Bidding: Understanding the Market’s Influence on Freight Rates

Lyle joined ATS in 2022 following more than 20 years in various roles within the transportation industry — although his entire life has been spent in the industry. Lyle spent many summers riding in the passenger’s seat as his dad delivered freight across the country. Over the course of his professional career, he served in roles in fleet operations, customer service, strategic planning and sales. Now serving as vice president and general manager of ATS Specialized, Lyle works on developing and mentoring his team through a strategic approach.

Confused about how freight rates work? You’re not alone! It can be difficult to understand the market and freight bidding.

Maybe you’ve heard that when rates go down for drivers, it’s because the carrier is taking more money for themselves. You could be left wondering how lowered rates in the market impact you. Maybe you don’t know what is and isn’t true and you’re just looking for some honest answers.

Carriers hear comments and questions like this several times a day every day. It’s the nature of the downturn market.

Let’s talk about it.

The market pushes rates around. So what can carriers control? How does freight bidding work between carriers and shippers?

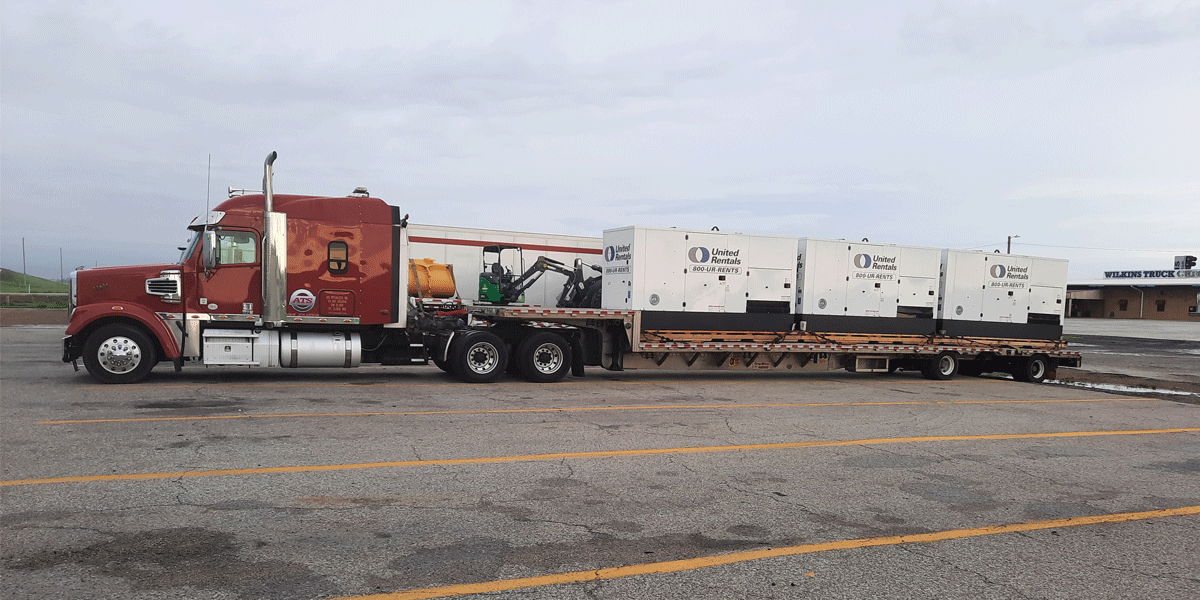

Anderson Trucking Service (ATS) works with both customer freight and load board freight, so we have a comprehensive understanding of how freight bidding works and how freight rates fluctuate — especially since we’ve been around since 1955.

This article will help you understand how carriers secure freight from customers and load boards and what goes into negotiating freight rates.

How Does Contract Freight Bidding Work?

Let’s start with how trucking companies bid on customer freight.

Rarely does a customer (shipper) reach out to a carrier first, unless the carrier hauls niche freight. Usually, the carrier reaches out to the customer to see if they can be considered for a bid. Customers can only handle a certain number of carriers in their network.

Carriers build relationships with customers and then the customer sends out a request for pricing (RFP) to a small group of carriers in their network. They’ll send this bid out to several carriers requesting pricing.

The RFP process is more formal than the spot market pricing process. Customers in the RFP process may want specific equipment (drop equipment) and a higher engagement from their carrier partners.

The RFP might have anywhere from five lanes to 15,000 lanes listed with details about origin and destination points and volume.

During the RFP process, the carrier has to analyze the freight lanes to determine if the lanes will work for the company. Then they need to come up with pricing.

Let’s dive further into each.

Analyzing the Freight Lanes

Each carrier analyzes the lanes that fit in its networks. Not all freight lanes work the same for all carriers. What’s good for one company might not be good for another.

Carriers have to carefully select lanes that allow them to be profitable and provide their drivers with good freight options.

First, carriers must consider if they have enough capacity to accommodate the additional lanes and fulfill the customer’s needs. If the freight requires drivers to have specific endorsements, the carrier needs to ensure their drivers have those endorsements. For instance, a carrier won’t bid on hazmat freight if their drivers aren’t able to haul it.

Location is also an important consideration. If the freight is primarily located on the west coast but the carrier is on the east coast and only works with regional or local drivers, that freight won’t work for the company. The carrier may prefer not to run freight in certain areas because it doesn’t fit into their particular model.

Quoting a Price

RFP processes are time-consuming and prices are typically agreed upon well before the freight is ever hauled. The contracts, completed up front, establish rates for a year or more.

Pricing is a tough, time-consuming task for carriers. They have to balance quoting the customer a good price so they win their desired lanes, while also ensuring costs are covered and drivers have access to good freight options. If a carrier’s prices are too high, they won’t secure the desired freight lanes.

It’s a delicate balance between ensuring the business makes enough money on each load to cover costs and pay drivers, while also making sure they don’t put the price so high that they’ll never win a contract.

Carriers use a metric to guide them in their pricing. Again, each carrier has a different focus. Every carrier takes into consideration its cents-per-mile requirement and weekly revenue per truck requirement. However, every carrier will put a different emphasis on each one.

The truck needs to earn enough revenue to cover the cost of the carrier and the driver. Those backend costs are built into every RFP. That includes everything from driver pay, equipment costs, fuel, truck and trailer maintenance, insurance fees and more. Carriers understand those costs and want to ensure drivers are paid to cover their expenses.

Carriers also have to look at where the freight is going. If it’s going into a bad market, the carrier may bid a higher rate to account for the empty mileage rate to get out of that market to a better freight area.

The market also has a large say in the price of freight. During down markets, when the economy is softer, supply tends to outweigh demand. Meaning, there are more trucks than freight. When the demand for trucks outpaces the supply, then rates go up. This ebb and flow is seen in the RFP process. Rates collectively go down in a down market.

The higher the rate, the more money everyone makes. Pushing rates lower doesn’t help anyone.

How Does Spot Market Freight Bidding Work?

Contract rates are a lot more stable — largely due in part to the contract freight rates being set and agreed upon so far in advance. While the market affects contract rates, it doesn’t affect them quite as intensely as spot market freight. The lows aren’t as low and the highs aren’t as high, so a lot of carriers try to keep a certain percentage of their business in contract freight.

Spot market freight can be volatile and it’s largely driven by smaller carriers or carriers that don’t operate in the contract freight business as much.

Remember how I said earlier that carriers have to get invited to an RFP? It’s usually the bigger carriers that get these invites. Small mom-and-pop companies (with around five trucks or less in the fleet) usually focus more on bidding through the spot boards.

That means there are a lot more carriers bidding on spot market freight as compared to the RFP bids. Competition is high.

Spot Bidding

Unlike the RFP process, which takes a long time, the spot market moves quickly. Carriers decide daily if a load being offered on the spot market works for their fleet.

Again, about 90 percent of business on the spot market is done by companies with less than five trucks.

The process of spot bidding may be quicker, but pricing is still the same. Carriers have to take a look at whether or not the load meets their requirements and then they bid accordingly. That means they’re considering driver pay and the cost to operate the truck.

Finding A Stable, Customer-Based Freight Company

It’s important to understand how freight bidding works so you can have a better understanding of how you’re being paid. When rates go down, it has an impact on everyone. When freight rates go up, it helps us all.

Carriers go through a different bidding process depending on whether they’re working directly with shippers or using load boards. Before bidding on freight, carriers carefully consider their capacity and how much money they need to bid on each freight lane or load to cover carrier and driver costs.

Finding a company with a wide range of customer-based freight is vital to your success; this type of freight can provide the stability you need to succeed as a driver. Learn more about why stability matters with your trucking company.

You can also learn about the difference between mega, mid-size and small carriers and their freight offerings to determine the best fit for you.