How to Prevent Fuel Card Fraud (and 2 More Types of Fraud) On the Road

Samantha joined the Anderson Trucking Family in November of 2012 as a specialized driver manager and managed a fleet of mixed company and contractor drivers. In the spring of 2014, she transitioned to the driver administration department and began working in contractor services. While in contractor services, Samantha familiarized herself with all processes, procedures and information in regards to driver contracts, pay and settlements. She is currently the operations support manager and oversees both the contractor services department as well as the driver settlement department and leads both of her teams to ensure our drivers receive the highest level of service required to help navigate their accounts and settlements on a daily basis.

Imagine how devastating it would be to tear into your paycheck expecting it to be thousands of dollars only to see zeros.

You work hard for your money. You’re out on the road for weeks at a time, away from your family, and working a difficult, laborious job. The last thing you want is for that hard-earned money to be stolen out from under you — especially when it’s thousands and thousands of dollars taken out of your settlements for fraudulent fuel purchases that can take months to resolve.

When you’re out on the road for long periods of time, trust is a tricky thing. It’s easy to feel lonely and to welcome friendly faces wherever you find them. But with so many truck drivers being victims of fraudulent behavior out on the road, how do you know who you can trust?

Can you trust that the person next to you at the truck stop getting coffee is really just looking for their next trucking opportunity, or are they probing you for personal information? Can you trust that the pump you’re fueling up at isn’t compromised?

There are a few ways you can be proactive out on the road to prevent your chance of becoming a victim of fraudulent behavior.

My job at Anderson Trucking Service (ATS) is to ensure our drivers feel like they’re taken care of financially. One of the biggest parts of my job is to make sure you have the support and education you need to make financially sound decisions.

In this article, I’ll explain how you can prevent fraud out on the road and what you should do if you think you’ve been impacted by a scam. I’ll break it down into the three primary types of fraud you’re subjected to including fuel fraud, personal identity fraud and identity theft. You’ll also learn more about how your trucking company may or may not support you if you’re ever subjected to fraudulent activity.

What is Fuel Card Fraud?

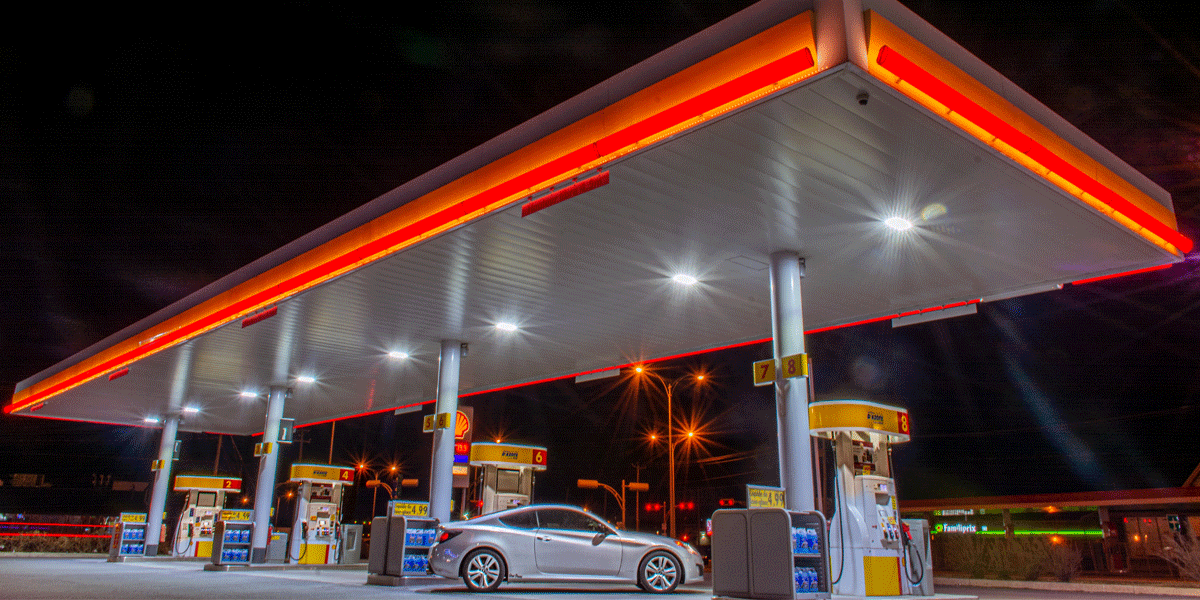

While skimming certainly isn’t new, we’re seeing a lot more of it happening as of late with the rise in fuel prices. At ATS alone, we’ve seen more than 10 cases of fuel pump fraud in the last month.

So how does it happen?

Fuel scammers target unknowing drivers at the pumps. They install skimmer devices on the pumps. When you swipe a credit card, debit card or fleet fuel card with a magnetic strip, the skimmer device copies the information from the magnetic strip. The device then transfers it to a local database or nearby computer.

From there, scammers are able to take blank cards and transfer your information onto the cards, creating replicas. They take those cards and use them to fill up on thousands of dollars of fuel.

You may be saying to yourself, But Sam, there’s a gallon limit on my fleet fuel card! How much could they possibly be stealing?

It’s a great question. Scammers are very good and they have ways to get around fuel limits. Some of them will make several purchases of about $500 for a few days at different stops around the country.

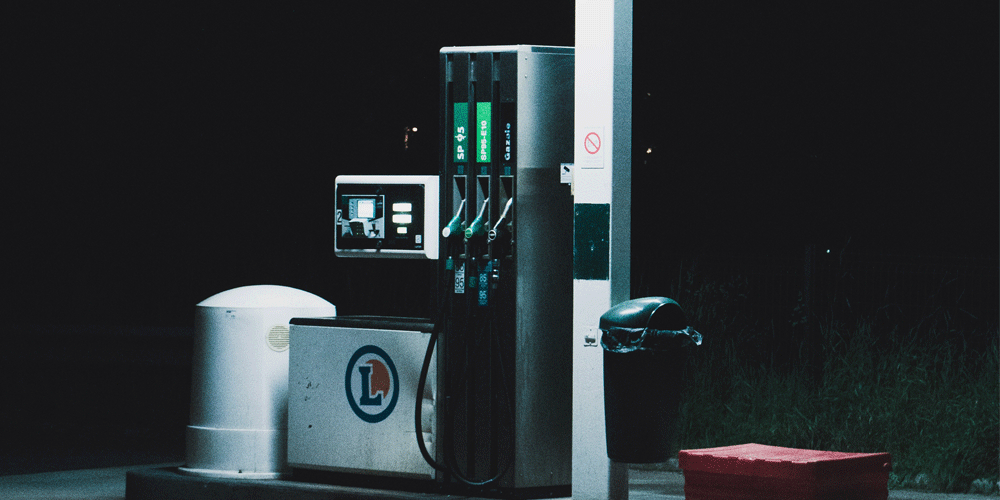

In some cases, they’ll head to an unmanned fuel station with an empty tanker trailer and fill the whole tanker up. Then they’ll go to a worksite or job site and sell that fuel cheap, pulling in 100 percent profit because the fuel is stolen.

It can be nearly impossible to catch these scammers. The people purchasing this fuel may not know they’re complicit in a scam. Some may be purchasing the fuel because they desperately need it and they can’t afford the current prices.

How to Spot and Prevent Fuel Fraud

Depending on whether you’re a company driver or an independent contractor, you may not realize this is happening. One of the ways you can keep track of fuel purchases is by monitoring the fuel log verifications that come through your in-cab computer. (Most carriers offer an automatic fuel log verification sent through electronic logging devices, but some do not.) These verifications detail the amount of fuel purchased, which station it was purchased at and the location of the station.

If you see one of these notifications come through and you were never in that state, something is wrong. At that point, you need to get in touch with your dispatcher or the department that handles truck fueling.

Whether you’re an independent contractor or a company driver, you should be monitoring these verifications. You may not be paying for fuel as a company driver so your settlements won’t be affected, but your company does pay for this. If they spend exorbitant amounts of money on fraudulent fuel purchases, they may start tightening their finances in other ways. That could be the difference between a pay raise and no pay raise.

You’re a company’s primary line of defense. Be sure you’re advocating for them by monitoring your fuel purchases and notifying your dispatcher if something looks wrong.

As an independent contractor, you’ll see this money come directly out of your settlements. So if you don’t notice fraudulent fuel logs, you’ll certainly notice it when your settlements arrive with far less money than expected. Depending on how much fuel was stolen, you can even be in the negative.

Keep your fuel receipts for at least 30 days and compare them to the fuel you’re charged for. This can be done in different ways depending on the company you work for. You may need to match the fuel charges to each trip or to the actual fuel statement you get each month. If there are extra charges, immediately notifying someone can prevent the fraud from continuing.

You can also avoid fuel skimming by paying inside and avoiding unmanned fuel stops. When you’re paying inside, there’s no risk of skimming devices being installed on the registers. Skimming devices are most likely to be installed at unmanned stops in secluded areas. This is because scammers are less likely to be spotted at these stations.

If the pump you’re fueling up at seems compromised — maybe the card reader is loose or it’s bulkier than it should be — choose another pump and let an attendant know.

Check out a few examples of skimming devices and compromised fuel pumps.

How Do Trucking Companies Support Drivers During a Fuel Scam?

Unfortunately, very rarely do scammers get caught. But that doesn’t mean you won’t get your money back. While every trucking company is different in how they’ll assist you and how you need to report the fraud, in general, as a contractor, you’ll need to report the fuel you’re claiming as fraud. Whether it’s a screenshot of the fuel log or fuel details listed on your settlement, you’ll use this proof to file a claim with the fuel card provider.

They’ll take the information you’ve provided and compare it to the tractor’s GPS coordinates. The review process can be long. It typically takes somewhere between 60 and 90 days for the fuel card company to determine whether the situation was a result of fraudulent behavior or not.

If you’re a company driver and this happened to you, the company will take care of this process. If you're a contractor, it can be a different story. The company you work with may or may not support you during this process.

Some companies make it entirely the driver’s responsibility to file the claim and suffer the financial burden. If the charges were deemed fraudulent, the money will be paid back to you. If not, you’re financially responsible and the money taken from your settlements won’t be returned to you.

Other companies will support you while you’re going through the process. If you suspect you have fraudulent fuel charges on your account, they’ll help you offset the burden. They’ll either put the money back in your account or they won’t deduct money from your settlement. They’ll park the debt and hold it in another account — maybe a promissory account — until the claim is resolved. That way, you aren’t held back from your goals while you’re awaiting the results of the investigation.

If it turns out that the charges were fraudulent, the fuel company will directly reimburse the trucking company. The promissory account will wash out and go back to zero. If the charges weren’t deemed fraudulent, because the company fronted you that money, you’ll owe your trucking company. Your company will decide if you need to pay in full or if you can make payments.

Don’t be afraid to inquire about your company’s fraud policy before you agree to work for them. It’s ideal to find a trucking company that will support you if this situation ever happens to you.

Two More Types of Driver Fraud in the Trucking Industry

Unfortunately, you may be more likely to be a victim of two other types of fraud when you’re on the road: identity fraud and identity theft.

Identity Fraud

Identity fraud is the act of an individual misusing your existing personal accounts. You can be targeted by identity fraud on the road in many ways.

The primary way I see identity fraud happen on the road occurs when drivers are targeted at truck stops. The scammer sees you pull up to fuel or rest for the night. They see your truck number and the logo of the company you work for slapped on the side of the truck. Then they target you in the station and start up a conversation.

Oftentimes, they use the guise that they’re looking for a new trucking company. They might not just ask you if you like the company; they might ask you more specific personal details, like where you’re from, how long you’ve worked for the company, where you’re heading to and where you just picked up from.

The scammer takes that information and calls your trucking company to request money. They have your truck number, your name and where you’re from. They know what kind of load you’re hauling and the load number. They’ll call the company and say, “Hey, I have a load going to Wisconsin. I just left Pennsylvania. I need more funds.”

Some companies may take that request at face value and send the money right away. The scammer might say they’ve changed their email address and need the money sent to a specific place. If that happens, that money advance is taken out of your next settlement — you’ll pay for it directly.

Other companies have safety measures put into place so that this doesn’t happen. They have two-factor authentication set up so you may need to provide a unique ID number or the last four digits of your social security number. They may have a specific way they distribute funds as well to ensure that they go to someone else.

Does this mean you should be skeptical of every person that chats you up in a truck stop? Certainly not. Just be careful that you don’t provide any personal information. Your name and phone number are usually fine — and a lot of this information can be sourced from social media anyway — but refrain from revealing much more than that.

If this situation happens to you, you’ll have to file a claim with your trucking company. They’ll investigate where the money was cashed and if you did, in fact, change your number and email address or if it was a scammer.

Identity Theft

Identity theft is the act of taking someone’s personal information and using it to impersonate them and/or create accounts.

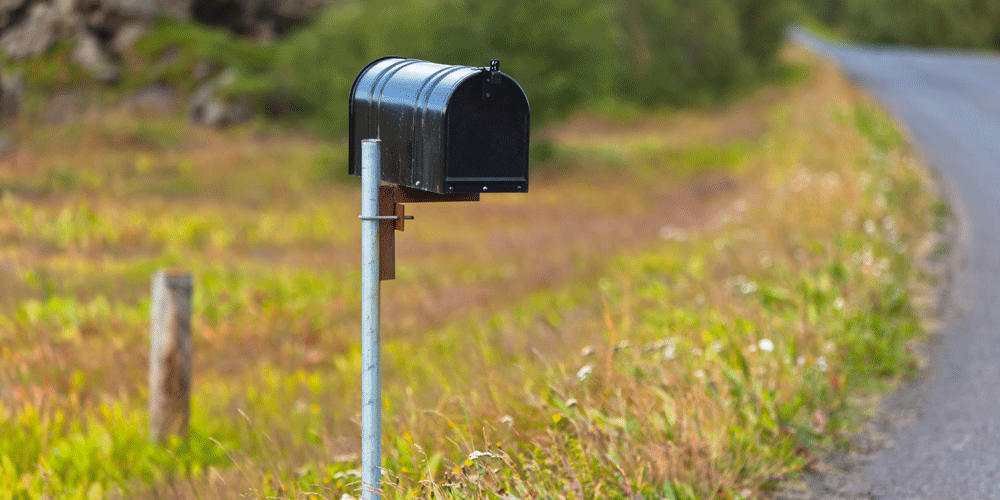

Because you’re out on the road more often than you’re at home, as a truck driver you’re more likely to be a victim of identity theft. When you’re out on the road, you can’t regularly check your mail. A number of companies send personal information through the mail, like credit card companies.

If someone gets into your mail and steals private information, they can try to open a line of credit or make a large purchase. Because you aren’t home to receive your mail, you might not receive the confirmation mail you’d get from opening a line of credit.

There are a few ways you can try to prevent this. First, consider investing in a P.O. Box. You’ll have a lockable mailbox at the post office, which prevents mail theft. You can also invest in a locked mailbox. You may also entrust a neighbor or close family member to retrieve your mail every day that you’re out on the road. Have them place your mail in a secure location.

Another option is to invest in identity theft insurance, which you can add to your homeowner’s insurance or renter’s insurance policy. This type of insurance can help you recover your account balances and cover the cost of a lawyer to fight fraudulent claims.

Be sure that you’re regularly monitoring your credit score. You’ll get notifications on your report when credit inquiries are conducted and you can fight this directly with the credit bureaus if it’s not a request you authorized.

Protect Yourself and Your Family

Fraudulent behavior is something I hope you never have to go through, but, unfortunately, it does happen. With these tools in place, you’re less likely to be a victim of these scams. But if you are, you’ll have a clear idea of what you need to do next.

You work hard on the road. You work hard for your family and you deserve to enjoy your life, retire when you want to and have the protection you need for your family.

Learn more about how you can secure the benefits you need to protect yourself and your loved ones.