Justin has been with ATS for over 13 years in varying roles. Following a five-year stint as a customer service representative with ATS Specialized, Justin began managing various sales and customer services teams where he prioritized putting the needs of customers first, day in and out. Today, as the director of sales, Justin's commitment to maintaining strong customer and professional relationships has only grown as he looks to provide a truly invaluable service at the highest possible level.

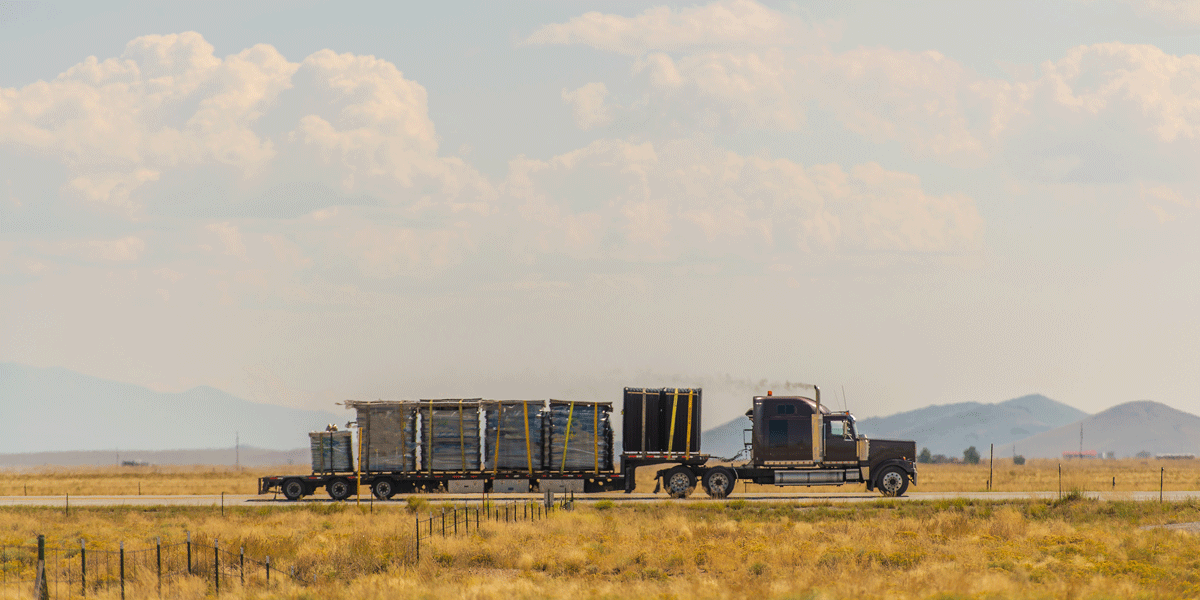

If you’ve been out on the road this year, you already know that 2025 didn’t exactly start with a bang for trucking. Freight markets remained tough in Quarter 1, and while there were a few bright spots, most drivers had to hustle just to keep their wheels turning and paychecks steady.

Some frontloading (shippers rushing to have their goods shipped before tariffs hit) did bring in some extra freight opportunities, but it was short-lived.

Sounds like more of the same, doesn’t it?

Trust us, here at Anderson Trucking Service (ATS), we’re pretty tired of this tough freight market, too.

Now, as we roll into Quarter 2, the big question is: Will things get better? We think it might.

Here’s your Q2 preview — what happened in Q1, what’s coming down the pipeline for freight rates and availability, and how you can make the most of the months ahead.

As always, we’ll give you an unbiased look into everything happening so you can adjust your trucking strategy accordingly.

What Happened in the Trucking Industry in Quarter 1?

If Q1 had a theme, it was “slow and steady recovery.” After nearly two years of market correction following the 2021 freight boom, many drivers entered 2025 hoping for a rebound. But January through March didn’t bring much relief.

Rates stayed low across most lanes, and competition remained high. Carriers continued to operate in a surplus environment with too many trucks chasing too few loads.

A growing number of small fleets and owner-operators have exited the market due to prolonged low margins, reducing available capacity. However, that capacity was eaten up by other drivers trying to run more miles.

Production for agriculture and construction equipment is down considerably compared to last year. Crop prices are down and interest rates are up which combines for a cash flow problem. Farmers are less inclined to purchase new equipment because skyrocketing interest rates make payments too high. As a result, we’ve been seeing mass layoffs at manufacturers across the country.

That said, some positive indicators emerged:

- Infrastructure improvements. As the U.S. works to improve its infrastructure, there’s an increase in power and renewable energy projects. It’s created a lot of freight opportunities to haul different components for data centers, utility lines, solar fields, and more. There’s uptake in oil and gas projects too. These projects are causing freight rates to increase.

- Spot pricing is going up. Power and energy projects created capacity crunches and sent shippers to the spot market. We’re seeing more spot market activity overall. This is different from what we saw just a year ago, where carriers accepted nearly every load offered to them.

- Market health. Rates in Q1 were about 3 percent higher nationwide than this time last year.

- Freight frontloading. The threat of tariffs caused shippers to increase their shipping volume in January ahead of tariff deadlines.

The bottom line? The freight market hasn’t bounced back yet, but it’s showing early signs of improvement.

Freight Rates in Quarter 2

Don’t expect a dramatic surge in freight rates this quarter, but keep your eyes on the long game.

Spring typically brings a modest uptick in demand thanks to seasonal shipping cycles. Produce, construction materials, lawn and garden supplies, and home improvement goods all begin moving more frequently. Carriers and owner-operators positioned to haul in these sectors may start to feel a slight lift.

However, it’s important to stay realistic. We’re not certain what spot rates are going to do and contract rates remain tight. The tariffs continue to be unpredictable.

The biggest opportunities may come from:

- Short-haul and regional lanes, where shippers are willing to pay for reliability.

- Specialized freight that requires flatbed, heavy haul, or other niche equipment.

Freight Availability in Quarter 2

Here’s the good news: There will likely be more freight this quarter than there was in Q1.

The second quarter is when things typically begin to ramp up for the year, especially in certain regions:

- Southern states will see increased produce volume.

- The Midwest and Northeast will kick off construction season, leading to a spike in building materials.

- Retailers begin stocking for summer promotions, driving van and reefer demand.

It’s not going to be a free-for-all, but if you’re flexible with your schedule and open to shifting your region or freight type, you’ll have a better shot at staying loaded.

Keep in mind: Freight is still expected to be inconsistent from week to week. Don’t let a slow Monday convince you the whole week is a wash. Stay connected with dispatch and lean into your network.

Tips for Successfully Hauling Freight in Quarter 2

Tough markets favor smart drivers. Here’s how to stay competitive in Q2:

Be flexible. The more open you are to different types of freight and routes, the more opportunities you’ll have.

Stick to your ETA and be efficient. Shippers are watching reliability closely right now. Showing up on time can mean the difference between getting passed over or offering consistent freight opportunities. Every minute matters, just like every load matters. Wasted time means less money in your pocket.

Stay on top of maintenance. Warmer weather is typically a lot more pleasant to drive in, but it doesn’t mean maintenance ends. Avoid preventable breakdowns that could sideline you during busy weeks.

Learn the freight market. The key to succeeding in this type of market is to understand headhauls and backhauls. Stay up to date on the freight market and trends so you can become better at choosing loads that will pay off.

Keep communicating. Whether it’s with your dispatcher or your load planner, open communication helps you stay ahead of changes and secure the best loads.

Looking Ahead in 2025

Quarter 2 may not be a breakout moment for trucking, but it does offer more opportunities than Q1 — especially for drivers who stay sharp, plan ahead, and stay flexible.

If you’re navigating the market and trying to make the most of every mile, keep your head up. The freight world is changing, and the drivers who adapt are the ones who come out ahead.

Make sure you continuously check informational sources like DAT, Truckstop.com, FreightWaves, and Trucker Tools to remain updated on current market trends and rate changes.

Subscribe to the Drive4ATS Learning Center here. We’ll be sure to keep you updated on market changes, too.