5 Signs Your Trucking Company Will Be Stable in the Trucking Downturn

Lars has been in the trucking industry his whole working life. He started working in the shop when he was just 16 years old. Lars spent about 10 years in operations before moving to driver recruiting. He spent five years in recruiting before joining the ATS team as the vice president of driver recruiting. He currently serves as the vice president of van operations. No day is ever the same in the trucking industry and Lars enjoys the challenge that presents.

The current market is straight-up confusing.

It’s not necessarily a bad market even though it feels like it is. The industry just came off two years with the highest freight rates we’ve seen in the history of trucking. Drivers and trucking companies became used to incredible rates.

Now, those rates have dropped and you might feel like you’re scrambling to get a decent paycheck.

Even though the rates have dropped, they’re still higher than what we were seeing pre-pandemic. Freight rates have been on the rise over the last decade, so drivers in 2019 were making far more than drivers in 2009.

But still, we're technically in a downturn market and drivers like you have had to adapt. You’re most likely looking for some stability right now.

Below, I’ll present five signs that a trucking company is stable and will survive the downturn market. They’re as follows:

- Debt-free

- Profitable

- Well-maintained fleet

- Healthy freight network

- Well-established

Understanding this information will help you evaluate if you’re running with a stable trucking company, or — if you’re searching for a new company — what you need to look for.

How Are Trucking Companies Struggling and How Does it Affect You?

Some trucking companies made decisions in the last two years when the market was hot that weren’t financially intelligent and now they’re struggling to stay afloat. Some companies made great financial decisions and they’re able to operate as per usual and offer stability to their drivers.

The companies that made bad financial decisions may have to force layoffs or close entirely. Some companies tried to buy trucks no matter how high the price got. Now they’re stuck with equipment they overpaid for. In turn, they have to maintain a higher rate than normal to erode the cost of that equipment.

Some companies overinvested in spot market freight. Some carriers even started running 100 percent spot market freight and now it’s going to be nearly impossible to keep running because they don’t have any steady customers.

Other companies outgrew their capacity and overexpanded without coming up with a plan to maintain that expansion. They took out huge loans but didn’t work on locking in contracted freight rates that would sustain them if the spot market tanked.

These five signs exemplify companies that have made smart financial decisions and can provide you with a more stable trucking job.

Sign #1: The Company is Debt-Free

If a carrier is debt-free, it’s usually a good sign. However, it can be difficult to determine if a company is debt-free unless they’re publicly traded. If they are publicly traded, it’s something that you can research easily. If the company isn’t publicly traded and they’re debt-free, they’ll probably be pretty vocal about it though.

A debt-free company is usually operating with a large cash surplus, so if there’s a period of no profitability, it can dip into its cash surplus to get through it.

A large amount of debt is perhaps the most dangerous and fatal thing for trucking companies in the market right now — especially for companies using rolling lines of credit with an unstable interest rate. If the Feds keep raising interest rates, carriers will have to still maintain that debt but at a higher interest rate.

Keep in mind, just as you’re concerned that you’re making less money, the trucking companies are making less money too; their profit margins are decreasing.

A company that has a large amount of debt might not necessarily be unprofitable, but it could struggle to make positive changes because changes cost money. For instance, the way this could play out is that it won’t go into further debt buying new equipment, so you may be stuck in older equipment longer. (This doesn’t even take into account the truck and parts shortages.)

On the other hand, a debt-free company might make some changes and go back to the basics of trucking when the market is tough, but they won’t cut corners or skip upgrading things because they can’t afford the debt.

Sign #2: The Company is Profitable

This may sound similar to sign #1, but a company can be debt-free but not profitable. Again, it can be difficult to find this information so you may need to do some digging. If the company is publicly traded, the data is readily available.

You want to work for a company that’s turning a profit. If they aren’t, you should question your long-term path with them.

Because most trucking companies will skirt around this question if you ask them how well they’re doing financially, there are a few things you can look for to determine if the company is profitable. For instance, look at the equipment and headquarters (if possible). If trucks are sitting around, unrepaired, or trucks are on the roads and poorly fixed, that’ll tell you they may be struggling financially.

If a company isn’t making money, it might lower driver pay. You might get paid late. The carrier could stop maintaining its trucks. Even worse, the company might start laying off drivers. That doesn't put you in a very stable position and it could very well affect your pay.

Additionally, if customers catch wind of the fact that the company isn’t profitable, they might cut you off. A lack of profit can make it harder to maintain customer contracts. If you stop fixing trucks, you’ll get caught at more scales. That leads to a lower safety score, which can make even more customers leave. Then drivers can get laid off and the company can close entirely. It’s a domino effect.

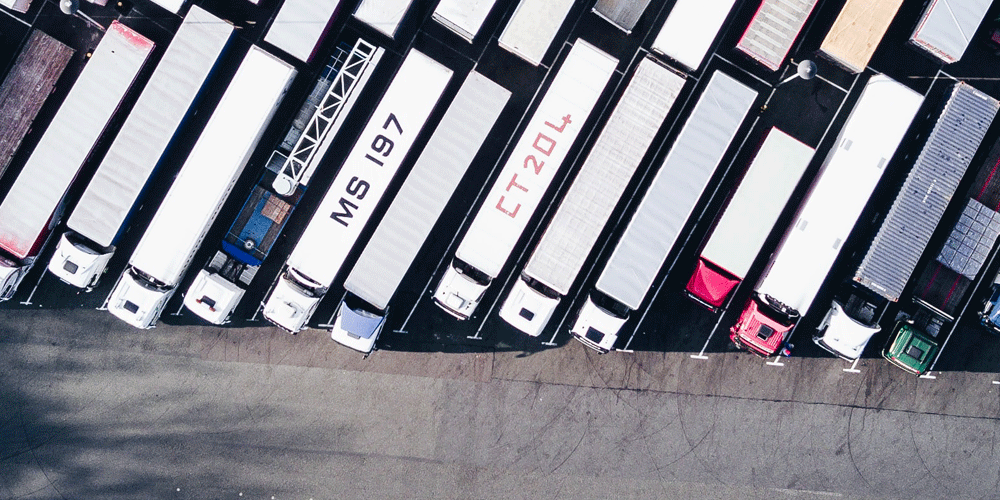

Sign #3: They Have a Well-Maintained Fleet

When companies start to run out of money, they might stop fixing things. Instead of fixing them, they’re just going to try to keep the truck moving. If trucks look beat up on the road, question whether the carrier is trying to cut corners because it can’t afford to fix the truck or it's being lazy.

Poorly maintained equipment is a symptom of a potential financial crash. Do you want to hedge your bets and work somewhere where they can’t even afford to maintain their equipment right now? What does that mean if this recession lasts two years? Can you ride it out there?

Eventually, that cost will translate to you as well. If you’re leasing a truck, you’re going to have to foot the repair for potentially costly repairs. You’ll also be shut down while the truck is fixed — whether you’re a lease operator or a company driver. When you’re not running, you’re not making money.

Additionally, when companies stop maintaining their equipment because they can’t afford to, they typically start cutting some of the comfort items in the truck. For instance, the carrier may not fix your air conditioning for a few weeks. Maybe your radio breaks and the company won’t replace it. These are small comforts on the road that can make your job feel even more difficult if they’re not working properly.

Sign #4: They Have a Healthy Freight Network

Lots of freight, or a booming freight network, is a sign of a healthy company that’ll last during the trucking downturn. Even a company with a larger customer base will suffer during this economy, but a carrier that has no diverse freight is going to struggle to move its trucks.

A company that relies on 100 percent spot market freight, or even largely on spot market freight, is going to suffer for two major reasons in this market. One, freight rates have decreased and, two, freight is less available. This is where it’s really important to have a wide customer base — otherwise, carriers can all but cease to move.

Even if a carrier has a lot of customers, it may struggle if it doesn’t have customers from a lot of different industries. For instance, let’s say a carrier is primarily transporting luxury goods. People aren’t buying luxury goods like they once were; instead, they’re shifting their spending to services and necessity items. Who do you think will do better in this economy? A carrier that only hauls grocery items or a carrier that only hauls luxury purses and shoes?

We saw this happen during the pandemic with a carrier that primarily hauled cars and auto parts. Because freight slowed significantly in this industry during the pandemic, and the carrier didn’t have a diverse freight base to pull from, it had to lay off a lot of drivers.

A diverse freight mix keeps drivers rolling. A good sign is if the carrier has a large logistics department. They typically have a large freight base to pick from. They look for freight all day, so they have better freight access.

What does this mean for you? It means that you’ll keep moving and keep making money.

Sign #5: The Company is Well-Established

A well-established company that has been around for decades has a good chance of getting through this economy — especially compared to a carrier that opened last week.

If companies have been around for a while, chances are they’re doing something right. They’ve been through hard times before, so they’ll have a strategy to withstand this market.

Some of these companies could have been around for the economic issues of the 1980s and then the great recession in the late 2000s. Some companies may have even been around since the 1930s and experienced even more market volatility.

Any event they’ve endured since the invention of the modern semi gives them a better chance of coming out the other end healthier than someone who just started a trucking company.

A well-established company will help you navigate this market. It’ll have sound strategies to keep you moving and generating a good profit.

Find a Stable Trucking Job

The important thing to take out of this article is this: Don’t panic.

Right now, we’re still in a better place money-wise than we were before the pandemic.

Don't panic and jump ship. The worst thing you can do right now is immediately quit your job and start jumping from carrier to carrier.

If a move is absolutely necessary for you, and you can sense your company isn’t doing well, spend time researching new, stable companies that you can drive for. Look for ones exhibiting the signs mentioned above. If you make the right decision, you might not have much of a change in your pay. If you choose wrong, it can be hard for you to jump back.

This article will help you understand what’s happening in the current market.

If you’re searching for a new, stable company, these companies will help you succeed in the downturn.